Major League Soccer today announced that it will leverage a historic $25 million loan from a syndicate of Black banks, marking the first time any sports league has participated in a major commercial transaction exclusively with Black banks.

Facilitated by the nonprofit National Black Bank Foundation (NBBF), the partnership is the latest significant step in a series of ongoing efforts by MLS in the Diversity, Equity and Inclusion space.

“Major League Soccer’s partnership with the National Black Bank Foundation is a tangible step in the efforts to close the racial economic gap in the United States, and it’s the right business decision for us,” said MLS Commissioner Don Garber. “As a league, we continue to increase our initiatives in support of racial justice. In order to make a genuine impact, economic justice must be part of the equation. This transaction with a syndicate of community-focused Black banks is an important measure, and it is our hope this will raise awareness of the importance of Black-owned banks and their impact on the economy.”

The transaction announced today, coupled with the league's strong credit rating, will grow the banks' capital cushion through fees and interest earned, creating additional capacity for new lines of credit for home and small business loans in communities of color across the country.

In facilitating the loan, the NBBF organized a syndication team led by Atlanta-based Citizens Trust Bank and New York-based Carver Federal Savings Bank.

"Major League Soccer has raised the bar for corporate America with this transformative partnership," said NBBF co-founder and general counsel Ashley Bell. "If other leagues and major corporations follow the MLS model, lives of Black families all across this country will change for the better because their local Black bank will have the capital resources to approve historic numbers of home and small business loans."

Historical context

Black banks fuel social mobility in the United States by connecting borrowers of color to capital. However, the sector's impact has been limited by a chronic, acute undercapitalization that has restricted the flow of credit it could create for underserved borrowers.

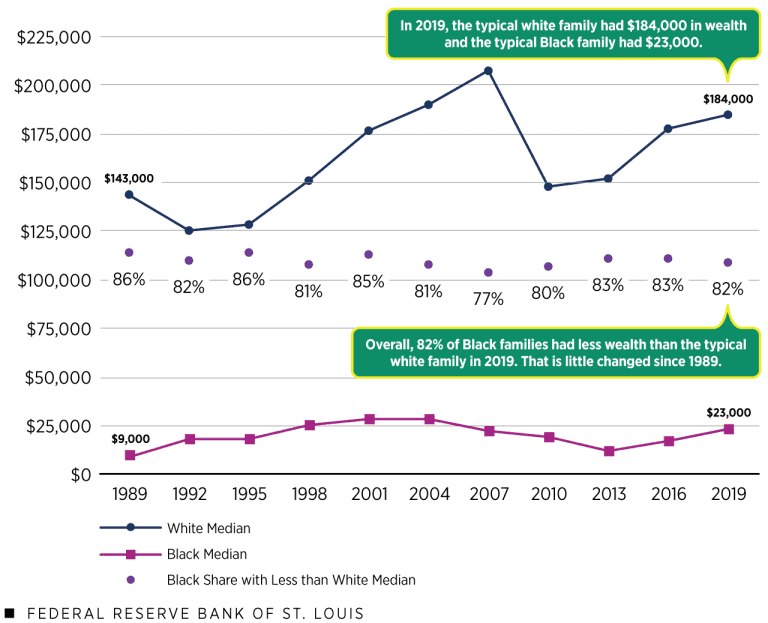

According to the Federal Reserve, the Black-white economic gap in the United States has remained virtually untouched since the Civil Rights Movement. Historical efforts by Black families to escape the continuum of poverty by building intergenerational wealth, primarily through homeownership and small business entrepreneurship, have been thwarted by racialized credit access. In 2020, lenders denied Black mortgage applicants at a rate 84% higher than white borrowers.

Transacting major deals with Black banks as MLS has done is one step of many in erasing America's racial wealth gap. These partnerships diversify Black banks' portfolio risk and grow their capital capacity to create and extend credit and other wealth-building services to Black borrowers.

Roughly half of all U.S. Black households were unbanked or underbanked in 2019, compared to just 15% of white families. The lack of access to essential financial services has forced Black households to rely on costly alternatives like check-cashing services, payday loans, money orders, and prepaid credit cards. Over a financial lifetime, those fees can total upwards of $40,000, according to the Brookings Institute.

Partners

As part of this partnership, MLS will work with the National Black Bank Foundation, 100 Black Men of America, Inc., National Coalition of 100 Black Women and Black Players for Change to educate their constituents and members on economic empowerment programming.

MLS and the National Black Bank Foundation worked with leaders across the league including club ownership, current and former MLS players and league officials to bring this landmark partnership to fruition.

The syndication team was led by Lead Arranger Citizens Trust Bank and Co-lead Arranger Carver Federal Savings Bank. Additional members of the syndicate include Alamerica Bank (Birmingham, Ala.), Carver State Bank (Savannah, Ga.), Columbia Savings & Loans (Milwaukee), Mechanics & Farmers Bank (Durham, N.C.) and Unity National Bank (Houston). Comer Capital Group, LLC served as financial and syndication advisor, and Dentons US LLP served as counsel.

“This transformative partnership between MLS and Black banks around the country is evidence of what can happen when leaders courageously stand up and decide to participate in equitable change,” said King Center CEO and National Black Bank Foundation board member, Dr. Bernice A. King. “I brought MLS and NBBF together because I saw an opportunity to create a partnership with the power to transform lives in Black communities and change hearts and minds throughout our nation. This deal undoubtedly marks an important moment in the continuing struggle for civil rights in the United States.”

Black Players for Change founder and 11-year MLS veteran Quincy Amarikwa noted: “Through securing deals like the one we celebrate here today, we directly address and establish a platform to overcome the undervaluing of Black participation in the economic ecosystem. Creating opportunities like this demonstrates that we are moving in the right direction. We welcome the opportunity to continue this positive forward momentum in partnership with MLS and others.”

In October 2020, MLS unveiled a series of initiatives aimed at combatting racism, advocating for social justice and increasing Black representation in the sport. Using the league's resources and platform to make tangible contributions to closing the racial wealth gap is one important component of MLS’ commitment to diversity, equity and inclusion.